net working capital is defined as quizlet

Explain how the money markets play a role in the relationship between the interest rates and the level of net working capital. B current assets minus current liabilities.

Chapter 8 Working Capital Mgmt Flashcards Quizlet

View Answer Castle View Games would like to invest.

. Net working capital is the aggregate amount of all current assets and current liabilities. Terms in this set 49 Net working capital is defined as. Working capital is generally defined as the difference between current assets and current liabilities.

Net working capital formula. A the value of a firms current assets. Thus if net working capital at the end of February is 150000 and it is 200000 at the end of March then the change in working capital was an increase of 50000.

C current liabilities minus current assets. Net Working Capital Definition In simple terms net working capital NWC denotes the short terms liquidity of a company and is calculated as the difference between the total current assets and the total current liabilities Net Working Capital Formula Lets have a look at the formula. Net Working Capital Current Assets less cash Current Liabilities less debt or NWC Accounts Receivable Inventory Accounts Payable The first formula above is the broadest as it includes all accounts the second formula is more narrow and the last formula is the most narrow as it only includes three accounts.

It is used to measure the short-term liquidity of a business and can also be used to obtain a general impression of the ability of company management to utilize assets in. In other words a companys ability to meet short-term financial obligations. Step-by-step solution Step 1 of 3.

Working capital is the sum of the cash and highly liquid investments that a business has on hand to pay for day-to-day operations. Also assume that the net working capital defined as current assets minus current liabilities levels of many corporations are relatively low in this period. D current assets minus current liabilities.

Gross working capital refers to the capital invested in the total asset of an enterprise. True False Uncertain Justify your answer. EXSC 301 Exam 2.

Net Working Capital Current Assets Current Liabilities 49433M 43625M 5808 million Net Operating Working Capital Operating Current Assets Operating Current Liabilities 30678M 34444M -3766 million. Having in-depth conversations on cash and net working capital as a whole are the best starting points. D total assets minus total liabilities.

NWC is a measure of a companys. E available cash minus current liabilities. Net Working Capital The difference between the firms current assets and its current liabilities Operating Cycle The time from the beginning of the production process to collection of cash from the sale of the finished product.

All of the above Answer - All of the above 10. Working capital also called net working capital NWC represents the difference between a companys current assets and current liabilities. It also includes available cash.

Net working capital current assets less cash current liabilities less debt Here current assets CA The sum of all short-term assets that are easily convertible into cash like accounts receivable debts owed to the company etc. You take all your total current assets. 1 Net working capital is defined as.

What is working capital. Net working capital is the sum of all current assets. NWC is a way of measuring a companys short-term financial health.

Net working capital is defined as a a ratio measure of liquidity best used in cross-sectional analysis. Current assets minus current liabilities. Net working capital is also known simply as working capital.

Net working capital which is also known as working capital is defined as a companys current assets minus itscurrent liabilities. If a companys owners invest additional cash in the company the cash will increase the companys current assets with no increase in current liabilities. You subtract your current.

What is net working capital. Excess or shortage of working capital is not disadvantageous for an enterprise. B the portion of the firms assets financed with short-term funds.

Net working capital is defined as current assets minus current liabilities the accounting statement which measures the revenues expenses and net income of a firm over a period of time is called the income statement the financial statement that summarizes a firms accounting value as a particular date is called the balance sheet. Examples of Changes in Working Capital. C the depreciated book value of a firms fixed assets.

Net working capital current assets - current liabilities What is permently working capital. Current assets Current liabilities Net working capital For these calculations consider only short-term assets such as the cash in your business account and the accounts receivable the money your customers owe you and the inventory you expect to convert to cash within 12 months. The capital which is raised or taken from long-term capital for.

The accounting statement that measures the revenues expenses and net income of a firm over a period of time is called the. Its ability to keep running and growing business operations. Net working capital is defined as current assets minus current liabilities.

AAAD 202 Midterm 1. Reorder Point The point at which to reorder inventory expressed as days of lead time daily usage Credit Standards.

Macroeconomics Flashcards Quizlet

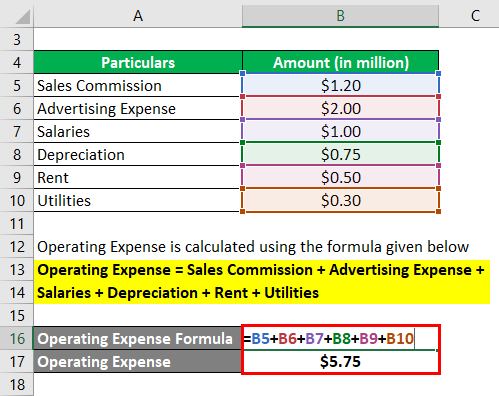

Operating Expense Formula Calculator Examples With Excel Template

Working Capital Management Flashcards Quizlet

Working Capital Flashcards Quizlet

Working Capital Management Flashcards Quizlet

Frl Chapter 2 Flashcards Quizlet

Chapter 6 Working Capital Flashcards Quizlet

Working Capital Management Flashcards Quizlet

Working Capital Finance Flashcards Quizlet

Working Capital Management Flashcards Quizlet

2 Bec Final Review Chap 2 Flashcards Quizlet

Working Capital Management Flashcards Quizlet

/dotdash_Final_How_is_a_Cost_of_Living_Index_Calculated_Oct_2020-01-f5552b1a61f44bc38cf63bee4f1b67b0.jpg)

How Is A Cost Of Living Index Calculated

Working Capital Management Flashcards Quizlet

Ch 2 Strategy Formulation Execution And Governance Flashcards Quizlet